virtual banking, referral programs, and the exciting realm of cryptocurrency. This isn’t just about managing your money; it’s about empowering entrepreneurs like you to take the driver’s seat and truly make your financial journey your own.

What is Virtual Banking?

So, what exactly is virtual banking? In simple terms, virtual banking refers to financial services that are delivered online without the need for physical branches. It allows you to perform banking transactions anytime, anywhere, through a digital platform. With virtual banking, you can check balances, make transfers, apply for loans, and manage your finances with just a few clicks or taps. At Twins Group, we’re redefining what it means to bank in the digital age through our innovative solution at iHold Bank.

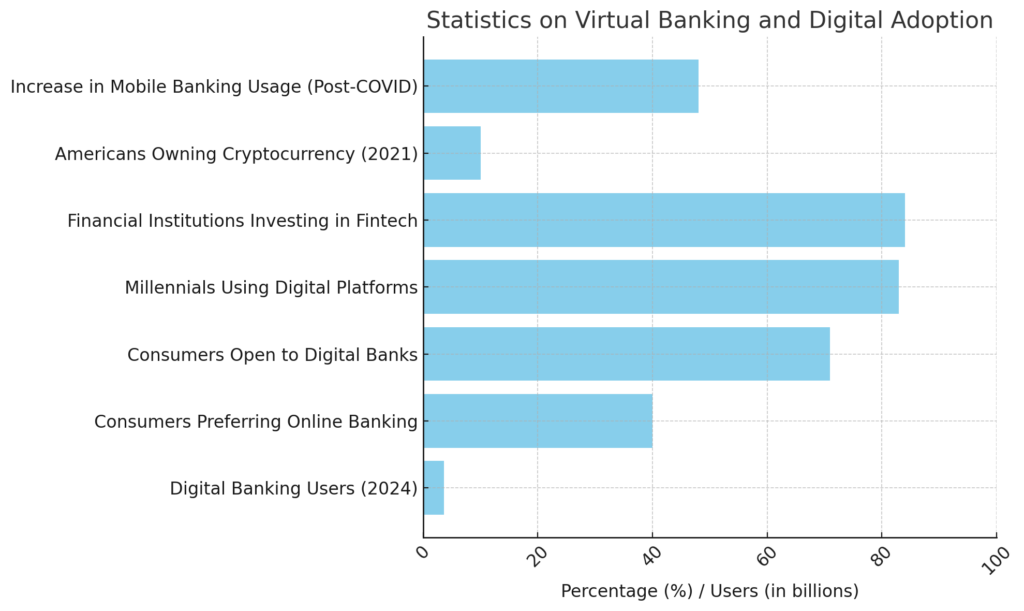

According to Statista, the number of digital banking users worldwide is expected to reach approximately 3.6 billion by 2024. This represents a significant increase in adoption as more consumers turn to online platforms for their banking needs.

Virtual Banking: The Future is Here

Picture this: managing your finances from anywhere in the world, all from the comfort of your smartphone. That’s the beauty of virtual banking! At Twins Group, we believe that banking should adapt to your lifestyle, not the other way around. With our cutting-edge virtual banking solutions, you can easily check balances, make transfers, and even pay bills, all while on the go.

And guess what? We’re not stopping there! Twins Group is integrating cryptocurrency into our banking ecosystem. Imagine paying for your services using crypto. Whether it’s Bitcoin, Ethereum, or any other cryptocurrency, you’ll have the freedom to choose how you transact. This opens up a world of possibilities and puts you in control of your financial decisions.

Benefits of virtual banking?

Convenience

24/7 Access: Virtual banking allows customers to access their accounts anytime, anywhere, using their smartphones or computers. This means you can manage your finances outside of traditional banking hours.

Cost Savings

Many virtual banks have reduced operational costs, which often translates into lower fees for services like account maintenance, ATM withdrawals, and transfers.

User-Friendly Interfaces

Virtual banking platforms often feature user-friendly interfaces that make it easy to navigate and perform transactions. Many apps are designed with simplicity and ease of use in mind.

Enhanced Security Features

Virtual banks typically implement high-level encryption, multi-factor authentication, and real-time fraud monitoring to protect customers’ financial information.

Many digital banks use AI and machine learning algorithms to detect and prevent fraudulent transactions quickly.

Personalized Financial Insights

Virtual banking platforms often provide personalized insights into spending habits and savings goals, helping customers make informed financial decisions.

Many virtual banks include tools to help users create budgets, set savings goals, and track their progress.

Faster Transactions

Digital transactions are often processed much faster than traditional methods, allowing for instant transfers and quicker access to funds.

Virtual banks often integrate with payment platforms, making it easy to pay bills or send money to friends and family.

Content

Integration with Financial Tools

Many virtual banking platforms allow integration with budgeting apps, investment platforms, and other financial tools, providing a holistic view of your finances.

Some virtual banks are now offering services related to cryptocurrencies, enabling users to buy, sell, and hold digital currencies easily.

Paperless Transactions

Virtual banking reduces the need for paper statements and transactions, contributing to environmental sustainability.

Customers can easily access and store digital records of their transactions and statements.

Accessibility

Virtual banking services can often be accessed from anywhere in the world, making it easier for expatriates or travelers to manage their finances.

Digital banking can help provide financial services to underserved populations who may not have access to traditional banking.

Customer Support

Many virtual banks offer various customer support options, including chat, email, and phone support, often with quicker response times than traditional banks.

Virtual banks often provide educational content to help users understand financial products and improve their financial literacy.

Unleashing the Power of Referrals

Now, let’s talk about our referral program. We all love sharing good news, right? When you refer your friends or family to our virtual banking services at Twins Group, you both get rewarded! It’s a fantastic way to introduce your network to a banking experience that truly understands their needs.

But here’s the twist: with our referral program, the money rolls in for you! Every successful referral means more rewards, more engagement, and more opportunities to grow your financial base. It’s a win-win situation that allows you to expand your network while enjoying the benefits of our services.

A New Era for Entrepreneurs

This isn’t just about banking; it’s about entrepreneurship! With our virtual banking solutions at Twins Group, you’re not just a customer; you’re a driver of innovation. Imagine the freedom to manage your finances, make investments in crypto, and leverage your referrals to create a steady income stream. This is your chance to take charge and make your financial dreams a reality.

By embracing virtual banking and cryptocurrency, you can position yourself at the forefront of financial innovation. This is not just a trend; it’s a movement. It’s about leveraging technology to enhance your financial literacy and create a more dynamic, engaging banking experience.

The Quest for Financial Freedom

So, are you ready to embark on this quest for financial freedom? With virtual banking and our referral program at Twins Group, the possibilities are endless. You have the power to manage your finances, pay with crypto, and build a community of like-minded individuals who are all working toward similar goals.

Join us at Twins Group as we redefine what it means to bank in the digital age. Let’s embrace innovation, foster connections, and drive towards a future where you are in the driver’s seat of your financial journey.

In conclusion, virtual banking, cryptocurrency, and referral programs are not just buzzwords; they are tools that empower you as an entrepreneur. Together, we can reshape the financial landscape and unlock new opportunities. So, let’s get started—your financial future awaits!